Tired of feeling confused and overwhelmed by the labyrinthine world of healthcare costs?

Ready to ditch the sticker shock and finally understand how copays actually work?

Say goodbye to the days of wondering if you’re paying too much or not enough.

This isn’t your typical rundown of common copays. We’re diving deep into 5 innovative copayment structures that are revolutionizing healthcare. Get ready to discover options that might just blow your mind – from tiered copays that reward healthy choices to personalized plans that adapt to your unique needs.

Whether you’re an employer looking for innovative benefits or an individual seeking greater cost transparency, these groundbreaking copayment structures will empower you to take control of your healthcare spending and unlock a new level of financial freedom.

5 Copayment Structures That Will Blow Your Mind 🤯

Navigating the world of healthcare costs can feel like deciphering ancient hieroglyphs. Between deductibles, premiums, and coinsurance, it’s enough to make anyone’s head spin. But one element often causing confusion is the humble copayment, that seemingly simple fee you pay at the doctor’s office.

While traditional copayments are straightforward, the healthcare landscape is constantly evolving, leading to innovative (and sometimes mind-blowing) variations.

Ready to ditch the confusion and unlock the secrets of these unconventional copayment structures? Let’s dive in!

1. Tiered Copayments: Your Health, Your Price Point 💰

Imagine a menu where the price of your healthcare depends on the type of service you choose. That’s essentially how tiered copayments work.

Instead of a flat fee, your copayment varies based on the tier assigned to each medical service.

- Tier 1: Basic services like routine checkups, vaccinations, and generic medications often fall in the lowest tier, meaning you’ll pay a smaller copayment.

- Tier 2: More specialized services, brand-name medications, or lab tests might fall into a higher tier, resulting in a larger copayment.

- Tier 3: Major procedures, surgeries, or expensive treatments typically reside in the highest tier, demanding the highest copayment.

Why it’s Mind-Blowing: 🤯 Tiered copayments incentivize patients to prioritize preventive care and choose lower-cost options whenever possible.

Think of it like: Choosing between economy, premium, and first-class airline tickets. ✈️

2. Value-Based Copayments: Paying for Outcomes, Not Just Visits 🏆

Tired of paying for procedures that don’t always deliver the desired results? Value-based copayments aim to change that.

Instead of focusing solely on the number of visits, these structures tie your copayment to the quality and effectiveness of the treatment received.

- Positive Outcomes: If your treatment leads to improved health outcomes, you might enjoy lower copayments.

- Negative Outcomes: Conversely, if your condition worsens despite treatment, your copayment could increase.

Why it’s Mind-Blowing: 🤯 Value-based copayments incentivize providers to prioritize patient well-being and deliver truly effective care.

Think of it like: Paying a bonus to your contractor for finishing a project ahead of schedule and under budget. 🏗️

3. Pay-for-Performance Copayments: Rewards for Healthy Habits 💪

Want to be rewarded for taking charge of your health? Pay-for-performance copayments are designed to do just that.

These structures offer lower copayments for patients who actively participate in healthy behaviors, such as:

- Regular exercise: Tracking your fitness progress could earn you discounts on future healthcare costs. 🏃♀️

- Healthy diet: Choosing nutritious foods and avoiding unhealthy habits might translate into lower copayments. 🍎

- Preventive screenings: Getting regular checkups and screenings could reward you with reduced healthcare expenses. 🩺

Why it’s Mind-Blowing: 🤯 Pay-for-performance copayments empower patients to become active participants in their healthcare journey.

Think of it like: Earning loyalty points for healthy choices, redeemable for discounts on healthcare services. 🛍️

4. Accountable Care Organization (ACO) Copayments: Teamwork Makes the Dream Work 🤝

Imagine a healthcare team dedicated to coordinating your care and keeping you healthy. That’s the essence of Accountable Care Organizations (ACOs).

ACO copayments often involve shared savings models, where patients, providers, and insurers collaborate to achieve better health outcomes.

- Lower Costs: If the ACO successfully manages patient care and reduces overall healthcare costs, patients might benefit from lower copayments. 💰

- Improved Coordination: ACOs prioritize seamless communication and coordination among healthcare providers, leading to more efficient and effective care. 🏥

Why it’s Mind-Blowing: 🤯 ACOs shift the focus from individual transactions to holistic, patient-centered care.

Think of it like: Joining a fitness club where everyone works together to achieve shared goals. 🏋️♀️

5. Personalized Copayments: Tailored to Your Needs 🎯

One-size-fits-all approaches rarely work in healthcare. Personalized copayments recognize this reality.

These structures tailor copayments based on individual patient factors, such as:

- Medical history: Patients with chronic conditions might have adjusted copayments to reflect their unique needs. 🩺

- Prescription drug usage: Patients taking expensive medications might benefit from lower copayments. 💊

- Income level: Income-based adjustments ensure access to affordable healthcare for everyone. 🤝

Why it’s Mind-Blowing: 🤯 Personalized copayments prioritize individual needs and promote equitable access to healthcare.

Think of it like: Custom-fitting a pair of shoes for optimal comfort and support. 👟

These innovative copayment structures represent a shift towards a more transparent, patient-centered, and ultimately, more effective healthcare system.

While traditional copayments might seem familiar, exploring these alternatives can empower you to navigate healthcare costs with greater clarity and confidence. 🧠💪

Frequently Asked Questions

Q: What are copayments?

A: Copayments are fixed amounts you pay for a healthcare service, like a doctor’s visit or prescription drug, at the time of service.

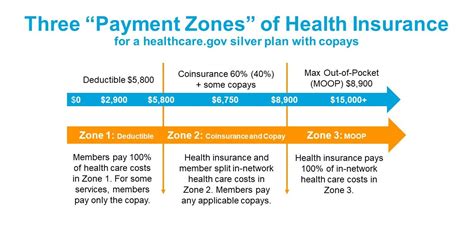

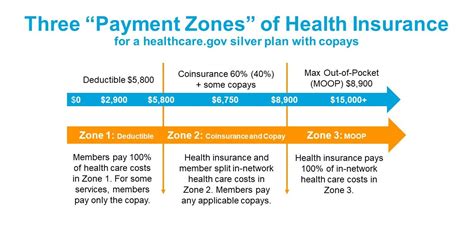

Q: Are copayments the same as deductibles?

A: No, copayments are different from deductibles. A deductible is the amount you pay out of pocket for covered health care services before your insurance plan starts to pay.

Q: Why would insurance companies have different copayment structures?

A: Insurance companies use different copayment structures to:

- Control costs:

- Encourage utilization of specific services:

Q: Which of the tiered copayment structures is best for me?

A: The best tiered copayment structure for you depends on your individual healthcare needs and usage patterns.

Q: What is a “personalized copayment”? How does it work?

A: A personalized copayment is a system where your copayment amount is tailored to your specific health condition or treatment plan.

Q: What are the potential downsides of copayment structures?

A: Some potential downsides include:

- Higher upfront costs:

- Delayed or forgone care:

Q: Is it possible to negotiate my copayments with my insurance provider?

A: It’s rare to successfully negotiate a lower copayment, but it’s possible in some situations, especially if you have unique circumstances.