Are you confident your health insurance plan is working for you, not costing you? Navigating the complex world of healthcare coverage can feel overwhelming, leaving you wondering if you’re making the right choices.

Think twice before you blindly renew your policy! Millions unknowingly fall victim to common healthcare plan pitfalls that drain their savings. From overlooking crucial details in fine print to missing out on valuable benefits, these mistakes could leave you footing hefty medical bills.

Ready to uncover the secrets of maximizing your health coverage and safeguarding your financial future? Dive into this guide revealing 7 health plan mistakes costing you thousands – and learn how to avoid them.

7 Health Plan Mistakes That Could Cost You Thousands 💰

Navigating the world of health insurance can feel like trying to decipher ancient hieroglyphics. With confusing jargon, endless options, and ever-changing rules, it’s easy to make costly mistakes that could leave you financially strapped when you need healthcare the most.

But fear not! This guide is here to shine a light on seven common health plan blunders that could cost you thousands of dollars and equip you with the knowledge to avoid them.

Let’s dive in!

1. Neglecting to Understand Your Plan’s Network 🏥

Imagine showing up for your doctor’s appointment, feeling confident about your coverage, only to receive a hefty bill because your provider isn’t in-network. 😨 Sounds frustrating, right?

Choosing a health plan solely based on premium price without considering its network can be a recipe for disaster.

Here’s the deal:

- In-network providers: These doctors, hospitals, and specialists have negotiated discounted rates with your insurance company. Visiting them typically results in lower out-of-pocket costs.

- Out-of-network providers: These healthcare professionals haven’t negotiated these discounts, meaning you’ll likely shoulder a larger share of the bill.

Action Step: Before selecting a plan, meticulously review its network directory. Ensure your preferred doctors, specialists, and hospitals are included. Don’t hesitate to contact your insurance provider directly if you have any doubts.

2. Ignoring Deductibles, Copays, and Coinsurance 💸

These terms often trigger confusion, but understanding them is crucial to avoiding financial surprises.

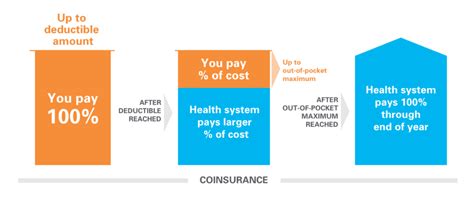

- Deductible: This is the amount you pay out-of-pocket for covered healthcare expenses before your insurance kicks in.

- Copay: This is a fixed amount you pay for specific services, like a doctor’s visit or prescription drug, regardless of the total cost.

- Coinsurance: This is the percentage of healthcare costs you share with your insurer after meeting your deductible.

Why it matters:

A high deductible might mean lower monthly premiums, but you’ll have to pay a larger chunk upfront if you require medical attention. Conversely, lower deductibles often come with higher premiums. Carefully weigh your potential healthcare needs against your budget when choosing a plan.

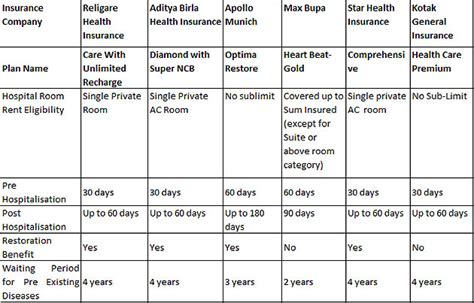

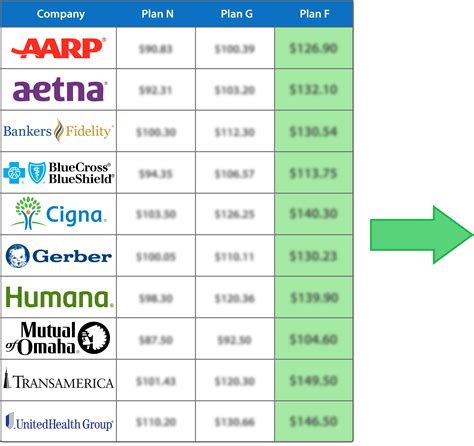

Action Step: Compare the deductible, copay, and coinsurance amounts across different plans. Calculate how much you might realistically spend in a year to determine the plan that aligns with your financial comfort zone.

3. Failing to Maximize Preventive Care Benefits 💯

Preventive care, like annual checkups, screenings, and vaccinations, is often fully covered by health insurance plans.

Don’t let this valuable perk slip through the cracks! Taking advantage of preventive care can not only save you money in the long run by catching potential problems early but also promote overall wellness.

Action Step: Review your plan’s preventive care benefits, noting what’s covered at 100% and schedule necessary appointments. Remember, prevention is often cheaper and less stressful than dealing with costly treatments down the road.

4. Underestimating Prescription Drug Costs 💊

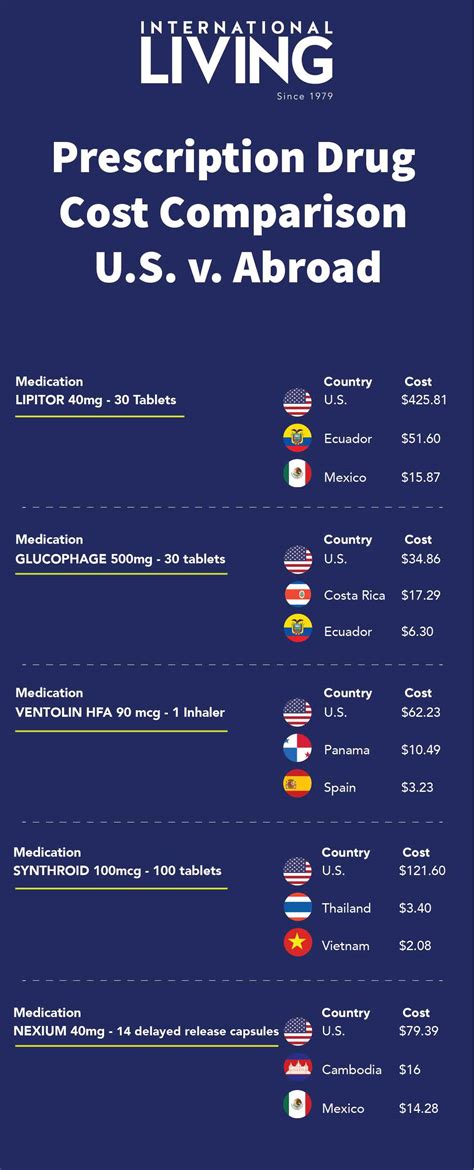

Prescription drug costs can be a significant drain on your finances.

Even with insurance, medications can come with hefty copays, deductibles, and coinsurance.

Here’s what you need to know:

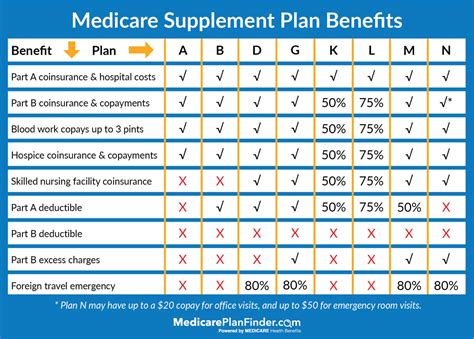

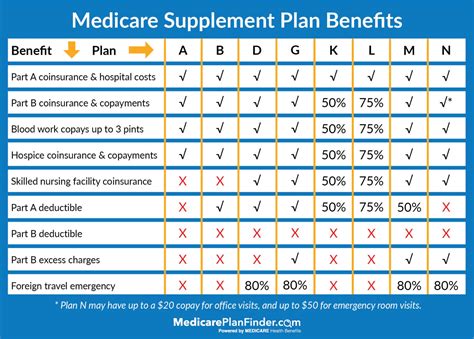

- Formulary: Your plan’s formulary lists covered prescription drugs, categorized by tiers. Medications in lower tiers typically cost less.

- Generic vs. Brand Name: Opting for generic drugs, when available, often saves you considerable money.

- Mail-Order Pharmacy: Using your insurer’s mail-order pharmacy may result in lower costs for long-term medications.

Action Step: Before filling a prescription, check your formulary and compare costs. Discuss generic options with your doctor. Consider using a mail-order pharmacy for ongoing prescriptions.

5. Missing Deadlines ⏳

Health insurance plans often come with deadlines for crucial tasks, such as enrollment, premium payments, and filing claims. Missing these deadlines can result in penalties, denied coverage, or unexpected out-of-pocket expenses.

Stay organized!

- Mark calendar reminders: Set reminders for open enrollment periods, premium due dates, and important deadlines.

- Utilize auto-pay: Enroll in automatic premium payments to avoid late fees.

- Keep documentation handy: Save copies of important documents, like insurance cards, policy summaries, and Explanation of Benefits (EOBs).

6. Skipping Annual Review 🧐

Your health and financial situation evolve over time, and your insurance needs may change accordingly.

Don’t assume your current plan remains the best option year after year.

Action Step: Review your health insurance plan annually during open enrollment. Assess if your coverage still meets your needs, compare prices, and explore alternative options if necessary.

7. Not Seeking Help When Needed 🆘

Navigating the complexities of health insurance can be overwhelming. Don’t hesitate to reach out for assistance!

- Your insurance provider: Contact your insurer’s customer service department with questions about your plan, benefits, or billing.

- Insurance brokers: Brokers can provide personalized guidance, compare plans, and help you make informed decisions.

- Government resources: Websites like Healthcare.gov offer valuable information and tools to assist with healthcare enrollment and understanding coverage options.

Avoiding these common mistakes can save you thousands of dollars in healthcare costs. Remember, knowledge is power! Take control of your healthcare finances by understanding your plan, maximizing benefits, and seeking help when needed.

FAQ

Q: What are some common health plan mistakes people make?

A:

- Not understanding your plan’s coverage: Failing to read your plan documents and understand your deductibles, copays, coinsurance, and out-of-pocket maximums.

- Choosing the cheapest plan without considering your healthcare needs: Opting for a plan solely based on price without evaluating its network, benefits, and coverage for your specific medical conditions.

- Neglecting preventive care: Skipping routine checkups, screenings, and vaccinations, which can lead to more expensive health issues down the line.

- Not utilizing your benefits: Forgetting about or not taking advantage of benefits like telehealth, prescription drug discounts, or wellness programs.

- Not reviewing your plan annually: Failing to compare plans during open enrollment and potentially missing opportunities for better coverage or savings.

- Inaccurate beneficiary information: Providing incorrect contact information or failing to update your dependents, leading to claim delays or denial.

- Ignoring prescription drug formularies: Not checking if your medications are covered by your plan’s formulary, which can result in unexpected costs.

Q: How can I avoid these mistakes?

A:

- Carefully read your plan documents and ask questions if anything is unclear.

- Consider your healthcare needs and budget when choosing a plan.

- Schedule regular checkups and screenings.

- Explore all available benefits and utilize them whenever possible.

- Compare plans annually during open enrollment.

- Keep your beneficiary information updated.

- Familiarize yourself with your plan’s prescription drug formulary.

Q: What are the potential consequences of making these mistakes?

A:

- Higher healthcare costs: Unexpected deductibles, copays, and coinsurance can significantly increase your out-of-pocket expenses.

- Delayed or denied claims: Inaccurate information or neglecting to utilize benefits can lead to claim processing issues.

- Missed opportunities for preventive care: Skipping screenings and vaccinations can result in more serious health problems requiring costly treatments.

- Financial strain: Unexpected medical bills can put a strain on your finances.