Tired of feeling trapped by high deductible waivers? Wishing you had more control over your healthcare costs? You’re not alone. Deductible waivers can feel like an unavoidable expense, but what if we told you there are strategies to lower them?

Discover 7 sneaky ways to slash those waivers and reclaim your financial peace of mind. From negotiating with providers to exploring alternative insurance options, this guide unveils hidden tactics that empower you to save big. Learn how to navigate complex healthcare jargon, uncover overlooked discounts, and leverage your unique circumstances to your advantage.

Ready to break free from the burden of high deductibles? Dive in and unlock the secrets to saving on your healthcare expenses.

7 Sneaky Ways to Slash Your Deductible Waivers

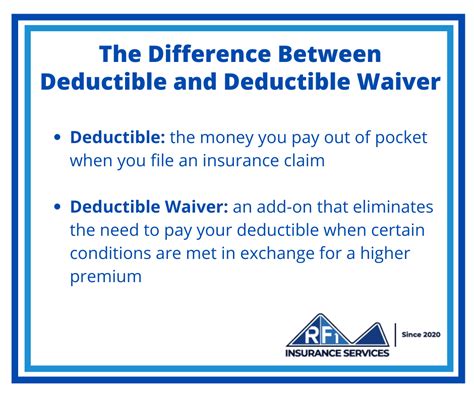

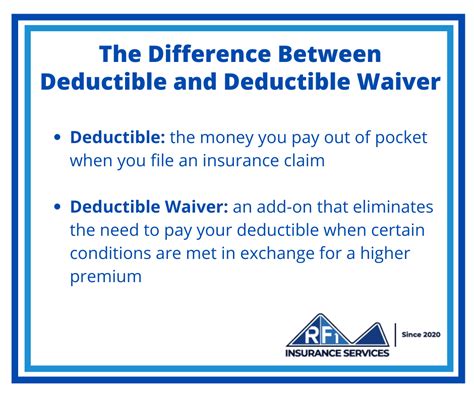

Navigating the world of health insurance can feel like trying to decipher an ancient language. Terms like “deductible” and “waiver” can leave you feeling lost and confused. But don’t worry, we’re here to break it down in plain English, specifically focusing on how to lower those dreaded deductible waivers.

A deductible waiver, simply put, reduces or completely eliminates your out-of-pocket expenses before your insurance kicks in. It’s like a golden ticket to cheaper healthcare, but some strategies can help you unlock this valuable benefit more easily than others.

Here are seven sneaky ways you can slash those deductible waivers and save yourself some serious cash:

1. Embrace the Power of Preventive Care

Preventive care isn’t just about staying healthy; it’s a strategic move for reducing your deductible waiver. Think of it as investing in your future healthcare savings.

How it works: Many health insurance plans cover preventive services at 100% with no deductible. This includes:

- Annual check-ups: A good old-fashioned physical exam can catch potential health issues early.

- Vaccinations: Stay up-to-date on your recommended immunizations.

- Screenings: Mammograms, colonoscopies, cholesterol checks—these screenings can detect diseases before they become serious.

By maximizing your use of preventive care, you’re not only keeping yourself healthy but also chipping away at your deductible waiver without spending a dime.

Pro tip: Check your specific insurance plan to see what preventive services are covered in full and schedule your appointments in advance to avoid missing out.

2. Leverage Life Events to Your Advantage

Life throws curveballs, and sometimes those curveballs come with insurance perks. Life events like marriage, job changes, or even having a baby can open up opportunities to adjust your health insurance coverage and potentially lower your deductible waiver.

How it works:

- Marriage: You may be able to join your spouse’s health plan, which might offer a better deductible waiver than your individual plan.

- Job Changes: A new employer could mean a new health insurance plan with a lower deductible waiver.

- Having a Baby: New parents often have access to special enrollment periods that allow them to make changes to their health insurance coverage.

Pro tip:

When life throws you a curveball, don’t hesitate to contact your insurance provider and explore your options. They’ll be happy to guide you through the process and help you find the best coverage for your needs.

3. Think Outside the Healthcare Box

While doctor visits and hospital stays are major healthcare expenses, don’t overlook smaller costs that can add up quickly. Eye exams, dental cleanings, and prescription medications are just a few examples.

How it works: Many health insurance plans offer separate vision and dental plans, sometimes with lower deductible waivers than your main health plan.

Pro tip: Talk to your insurance provider about bundled health plans or partnerships with vision and dental providers.

4. Negotiate Like a Pro

You wouldn’t buy a car without haggling, right? The same goes for your health insurance. While you can’t necessarily negotiate your premium, you might be surprised at what you can do regarding your deductible waiver.

How it works:

- Ask about discounts: Inquire about discounts based on factors like your age, health status, or family size.

- Explore different payment options: Paying your premium annually could lead to a lower deductible waiver.

- Bulk up conversations: Consider combining medical student loan forgiveness opportunities with your negotiation.

Pro Tip: Don’t be afraid to ask for what you want. Insurance companies are used to negotiating, and you might be able to score a better deal than you initially thought.

5. Join a Health Savings Account (HSA)

HSAs are triple-tax advantaged accounts that can be paired with a high-deductible health plan. They work as a savings vehicle for qualified medical expenses, allowing you to contribute pre-tax dollars, grow your money tax-free, and withdraw your funds tax-free for eligible healthcare costs.

How it works:

- Lower deductibles: Since you are contributing to an HSA, your deductible can be lower appealing for those with coverage gaps.

- Year-round savings:

You don’t have to wait for medical expenses to roll around to start saving. Pro Tip:

Even if you don’t need to use the entire amount in your HSA, it can be a great way to build your long-term healthcare savings nest egg.

6. Charter Member Perks (Think Small Business)

If you’re a small business owner or entrepreneur, consider joining business groups that offer health insurance options.

How it works:

- Collective bargaining power:

By pooling resources with other businesses, you can negotiate lower premiums and potentially lower deductible waivers.

Pro Tip:

Research different business groups and compare their insurance offerings to find the best fit for your needs and budget.

7. Review Your Coverage Annually

Don’t be complacent with your health insurance plan.

How it works:

- Changes in your life:

As your life evolves, so should your health insurance. Regularly review your coverage to ensure it still meets your needs.

- Market fluctuations: Insurance plans and deductible waivers can change year to year. By reviewing your options annually, you can lock in the best possible deal.

Pro Tip: REMEMBER OPEN ENROLLMENT!

Open enrollment periods are a specific time of year when you can make changes to your health insurance coverage. This is a prime opportunity to explore new options and potentially lower your deductible waiver.

The Bottom Line

Navigating the world of health insurance can be a challenge, but understanding your options and being proactive can make a big difference in your healthcare costs. By implementing these sneaky strategies, you can significantly lower your deductible waivers and get more bang for your buck. Remember, knowledge is power! Empower yourself with information and take control of your health insurance journey.

Frequently Asked Questions

- What is a deductible waiver?

A deductible waiver, often offered with insurance policies, reduces or eliminates the amount you’re responsible for paying out-of-pocket before insurance coverage kicks in.

- Are deductible waivers right for everyone?

Deductible waivers can be beneficial, especially for individuals who anticipate needing frequent medical care or dealing with unexpected emergencies. However, they often increase monthly premiums, so weigh the costs and benefits carefully.

- How can I learn more about deductible waivers offered with my insurance policy?

Contact your insurance provider directly. They can provide specific details about the waiver options available to you, eligibility requirements, and potential costs.

- What are some alternatives to deductible waivers?

Consider factors like increasing your deductible to lower monthly premiums or exploring different insurance plans with lower overall costs.

- Are there any drawbacks to using deductible waivers?

Higher monthly premiums are a common drawback. Additionally, waiver terms and conditions vary, so carefully review any fine print to understand limitations and exclusions.

- Can I cancel a deductible waiver if I decide it’s not beneficial?

Policies regarding waiver cancellation vary. Contact your insurance provider to understand the terms and potential penalties for cancellation.

- Can I get a deductible waiver for all types of insurance?

Deductible waivers are primarily associated with health insurance but may be available for other types of insurance, such as property or auto.

- What qualifies as a medical emergency for deductible waiver purposes?

Specific criteria defining medical emergencies can vary depending on your insurance plan. Review your policy documents for detailed explanations.

- Are deductible waivers taxable?

Generally, deductible waivers themselves aren’t considered taxable income. However, consult with a tax professional for personalized advice.