Are soaring healthcare costs leaving you feeling overwhelmed? Worried about providing adequate coverage for your loved ones? You’re not alone. Navigating the complex world of health insurance can feel daunting, especially when considering dependents.

But what if we told you there’s a powerful tool you might be overlooking?

Dependents coverage, often bundled with employer-sponsored plans, offers incredible value and financial security. It’s a lifeline that protects your family from unexpected medical bills, ensuring everyone gets the care they need, without breaking the bank.

Ready to discover how dependents coverage could save you thousands? Let’s dive into five surprising ways this often-underestimated benefit can make a significant difference in your financial well-being.

5 Ways Dependents Coverage Could Save You Thousands 💰

Life throws a lot of curveballs, and unexpected medical expenses are definitely one of them. That’s why having comprehensive health insurance is crucial, especially when you’re responsible for the well-being of dependents. While premiums can feel like a significant chunk of your budget, the peace of mind and potential savings associated with dependents coverage are invaluable.

Let’s explore five compelling reasons why dependents coverage could be a lifesaver (literally!) and potentially save you thousands of dollars in the long run.

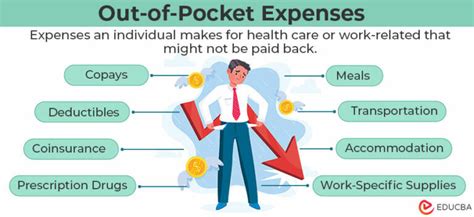

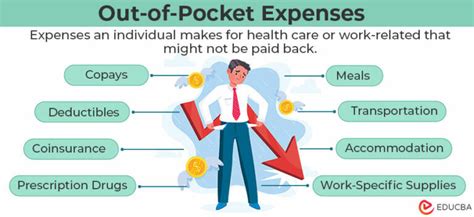

1. Prevent Costly Out-of-Pocket Expenses 🏥💸

Imagine this: Your child trips and falls, breaking their arm. You rush them to the ER, and the medical bills start rolling in. This scenario could easily cost thousands of dollars without proper insurance coverage.

Dependents coverage acts as a financial safety net, shielding you from the exorbitant costs associated with treating unexpected illnesses and injuries. It helps cover medical expenses like doctor visits, hospital stays, surgeries, prescription drugs, and even mental health care.

Without dependents coverage, you’d be solely responsible for these costs, potentially accumulating significant debt or depleting your savings.

2. Access to Routine Healthcare 🍎🦷🩺

We all know prevention is key, but regular checkups and preventive care can be expensive, especially for families. Dependents coverage typically includes coverage for routine services like:

-

Well-child visits: These are crucial for ensuring your child’s healthy development and catching potential issues early on.

-

Dental and vision care: These frequently overlooked expenses can add up quickly, but dependents coverage often provides access to affordable dental and vision plans, ensuring your family’s overall well-being.

-

Vaccinations: Protecting your family from preventable diseases is essential, and dependents coverage usually covers the costs of vaccinations, safeguarding your loved ones’ health.

By accessing routine healthcare through dependents coverage, you can prevent small issues from becoming major problems down the line, saving you time, stress, and potentially thousands of dollars in future medical expenses.

3. Financial Protection for Unexpected Events ⛈️🆘

Life is unpredictable, and accidents can happen anytime, anywhere. A sudden illness, a car accident, or a complex medical procedure can lead to substantial medical bills, even for seemingly minor incidents.

Dependents coverage provides crucial financial protection during these unforeseen events. You won’t be left scrambling to cover unexpected expenses, risking your financial stability and well-being.

4. Peace of Mind and Reduced Stress 😌

Knowing that your family is protected by comprehensive health insurance gives you invaluable peace of mind. You can focus on what truly matters – caring for your loved ones – without the constant worry of potential medical bills overwhelming your finances.

Financial stress can take a toll on your mental and emotional health. Having dependents coverage eases this burden, allowing you to navigate life’s challenges with greater confidence and resilience.

5.Tax Benefits 💰

Depending on your individual circumstances, dependents coverage can offer valuable tax benefits.

Often, your health insurance premiums are tax-deductible, reducing your overall tax liability. Consult with a tax professional to understand the specific tax benefits available to you based on your situation.

Making the Right Choice for Your Family

Weighing the costs and benefits of dependents coverage can be daunting, but remember, the potential savings and peace of mind it provides are immeasurable.

Here are some key factors to consider when making your decision:

- Your family’s health needs:

Assess your family’s current health status, pre-existing conditions, and potential future health risks. A family with young children or members with chronic conditions may benefit significantly from comprehensive coverage.

-

Your budget: Compare premiums and coverage options to find a plan that fits your budget without sacrificing essential coverage.

-

Employer-sponsored plans:

Take advantage of your employer’s health insurance offerings and consider the value of dependents coverage.

Ultimately, dependents coverage is an investment in your family’s health and well-being. It provides financial security, access to quality healthcare, and peace of mind, knowing you’re prepared for whatever life throws your way.

Dependents Coverage FAQ

Q: What is dependents coverage?

A: Dependents coverage is a healthcare plan addition that allows you to extend health insurance benefits to eligible family members, typically spouses and children.

Q: Who qualifies as a dependent under a health insurance plan?

A: Dependents typically include:

- Spouse: This often includes legal spouses and domestic partners, depending on your plan’s specifics.

- Children: Children usually qualify until a certain age, often up to 26, though some plans may extend coverage further.

Q: How much does dependents coverage cost?

A: The cost of dependents coverage varies widely based on factors like:

- Individual and family health history

- The type of plan you choose (e.g., HMO, PPO)

- Your state of residence and employer’s plan.

Q: Can I add dependents to my insurance plan later?

A: Yes, but you’ll usually need to do so during an open enrollment period or when experiencing a qualifying life event, such as marriage or the birth of a child.

Q: What happens if my dependent turns 26?

A: Most health insurance plans automatically end coverage for dependents at age 26. However, some exceptions exist, such as for children with disabilities.

Q: What are the potential savings of dependents coverage?

A:

- Avoiding High Individual Premiums: Getting coverage through an employer or individual plan may be significantly cheaper than obtaining separate plans for you and your family.

- Access to Healthcare Without Gaps: Dependents coverage ensures everyone in your family has continuous health insurance, preventing financial strain from unexpected medical costs.