Tired of that hefty annual deductible looming over your insurance policy? Wishing you could trim that hefty expense without sacrificing coverage? You’re not alone!

The good news is, there are sneaky ways to slash your deductible and breathe easier financially. We’re unveiling seven clever strategies, straight from the insurance insider’s playbook, to help you reclaim your hard-earned money.

Discover how simple adjustments to your lifestyle, smart shopping choices, and unexpected policy hacks can save you hundreds, if not thousands, each year.

Get ready to unlock the secrets of deductible reduction – your wallet will thank you.

7 Sneaky Ways to Slash Your Annual Deductible 💰

Let’s face it, nobody loves paying deductibles. Those hefty upfront costs can feel like a punch in the gut, especially when unexpected medical expenses arise. But what if we told you there are ways to sneakily lower that deductible and save yourself some serious cash? 🤫

Don’t worry, we’re not talking about shady schemes or breaking the bank. These strategies are legitimate, actionable, and designed to help you take control of your healthcare costs.

Ready to uncover these hidden gems? Let’s dive in!

1. Negotiate Like a Boss 💼

You wouldn’t buy a car without haggling, right? Well, your health insurance deductible shouldn’t be any different.

Many insurance companies are willing to negotiate, especially if you’re a loyal customer or have a clean medical history.

- Gather Your Information: Before you pick up the phone, research average deductibles for similar plans in your area.

- Highlight Your Value: Emphasize your positive attributes, like your healthy lifestyle or lack of claims history.

- Don’t Be Afraid to Walk Away: If they refuse to budge, be prepared to explore other options.

Remember, the worst they can say is no!

2. Embrace the HSA Power 💰

A Health Savings Account (HSA) is a triple-threat weapon against high deductibles.

- Tax Advantages: Contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free.

- Deductible Reduction: HSAs are paired with high-deductible health plans (HDHPs), which often have significantly lower monthly premiums.

- Long-Term Savings: Funds roll over year after year, building a nest egg for future healthcare costs.

Think of it as a savings account specifically for your health.

3. Maximize Your Flexible Spending Account (FSA) 💳

Similar to HSAs, FSAs offer tax advantages for healthcare expenses.

- Pre-Tax Contributions: Money comes directly out of your paycheck before taxes, reducing your taxable income.

- Use-It-or-Lose-It: Unlike HSAs, FSAs typically operate on a “use-it-or-lose-it” basis.

Plan ahead and anticipate expenses like copays, prescriptions, and dental work.

4. Shop Around Like a Savvy Consumer 🕵️♀️

Don’t settle for the first insurance plan you encounter.

- Compare Apples to Apples: Look beyond monthly premiums and focus on deductibles, copays, and out-of-pocket maximums.

- Consider Different Networks: Narrow networks often have lower premiums but limited provider choices.

- Utilize Online Tools: Websites like Healthcare.gov and NerdWallet can help you compare plans side-by-side.

Remember, finding the right plan takes research and effort, but it’s worth it in the long run.

5. Preventive Care is Your Friend 💪

Staying healthy is not only good for you, it’s also good for your wallet.

- Free Screenings: Many insurance plans cover preventive screenings, like mammograms, colonoscopies, and blood pressure checks, at no cost.

- Early Detection Saves Money: Catching health issues early often leads to less expensive treatments down the road.

- Make Wellness a Priority: Engage in healthy habits like regular exercise, a balanced diet, and stress management.

Investing in your health today can save you money tomorrow.

6. Explore Employer-Sponsored Benefits 💼

Your employer may offer valuable perks beyond your health insurance plan.

- Wellness Programs: Some companies offer incentives for participating in fitness challenges, smoking cessation programs, or biometric screenings.

- Employee Assistance Programs (EAPs): EAPs provide confidential counseling and support for mental health, financial stress, and other personal issues.

- Health Reimbursement Arrangements (HRAs): HRAs reimburse employees for eligible medical expenses, potentially reducing your out-of-pocket costs.

Don’t overlook these hidden gems!

7. Review Your Plan Annually 🗓️

Your healthcare needs and circumstances change over time.

- Open Enrollment: Take advantage of annual open enrollment periods to compare plans and make adjustments.

- Life Events: Major life changes, like marriage, childbirth, or job loss, may qualify you for special enrollment periods.

- Stay Informed: Keep up-to-date on healthcare trends, insurance regulations, and potential savings opportunities.

Being proactive about your health insurance ensures you’re always getting the best value.

Remember, lowering your deductible is a marathon, not a sprint. Implement these strategies gradually, track your progress, and celebrate your successes along the way. 🏆

FAQ

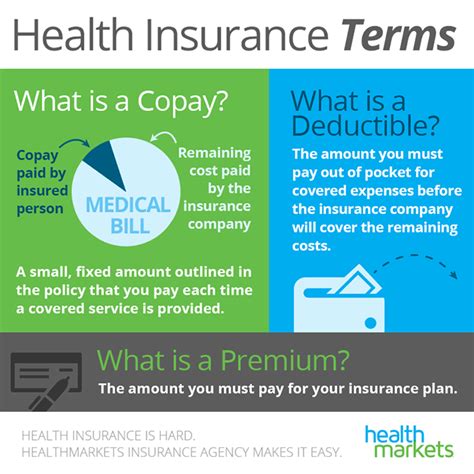

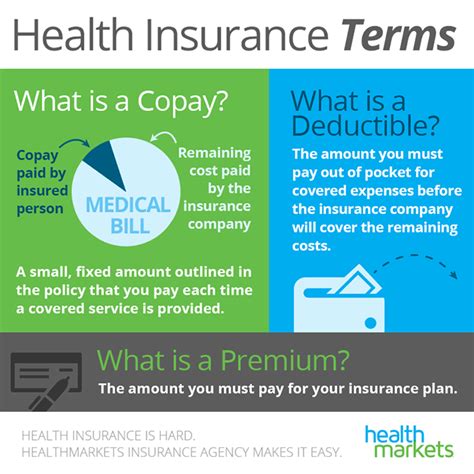

Q: What exactly is an annual deductible? A: Your annual deductible is the amount you pay out of pocket for covered healthcare expenses before your insurance plan starts paying.

Q: Will these tips actually save me money on my deductible? A: These strategies can help lower your out-of-pocket expenses and potentially reduce your overall deductible amount.

Q: Are these tips legal and ethical? A: Yes, all these tips are safe and legal ways to manage your health insurance.

Q: Do I need to be in good health to use these tips? A: No, these tips can benefit everyone, regardless of their health status.

Q: How often do I need to do these things to see a difference? A: Consistency is key!

Q: Can I combine these tips with other strategies to save even more? A: Absolutely!

Q: Where can I find more information about my specific insurance plan? A: Contact your insurance provider directly or review your policy documents.

Q: Are there any downsides to using these tips? A: While these tips can be beneficial, pay close attention to any plan stipulations or potential penalties.