Are you tired of feeling financially vulnerable? Worried about unexpected expenses throwing your life off balance? Imagine a safety net strong enough to catch you, no matter what life throws your way. Comprehensive coverage expansion isn’t just about insurance; it’s about peace of mind, financial security, and the freedom to pursue your dreams without fear.

Ready to unlock a world of possibilities? Discover seven transformative ways comprehensive coverage expansion can revolutionize your life, empowering you to navigate challenges with confidence and embrace a future filled with opportunity. From protecting your loved ones to safeguarding your financial stability, get ready to explore the profound impact comprehensive coverage can have on your journey.

7 Ways Comprehensive Coverage Expansion Will Change Your Life

We all crave peace of mind, knowing that we’re protected from life’s unexpected twists and turns. While we can’t predict the future, we can prepare for it. And one powerful way to do that is through comprehensive coverage expansion.

Think of comprehensive coverage expansion as your safety net, designed to catch you when the unexpected happens.

It’s about ensuring you have the financial resources and support you need to navigate challenges, pursue opportunities, and ultimately, live a richer, more fulfilling life.

Ready to discover how comprehensive coverage expansion can revolutionize your world? Let’s dive in!

1. Financial Security: Your Anchor in Uncertain Times

Life throws curveballs. Job loss, unexpected medical expenses, property damage – these events can send financial shockwaves through even the most stable lives. Comprehensive coverage expansion acts as your financial anchor, providing a safety net to weather these storms.

Imagine facing a major medical emergency. Without comprehensive coverage, the financial burden could be crippling.

But with expanded coverage, you’d have access to essential healthcare, reducing stress and allowing you to focus on recovery.

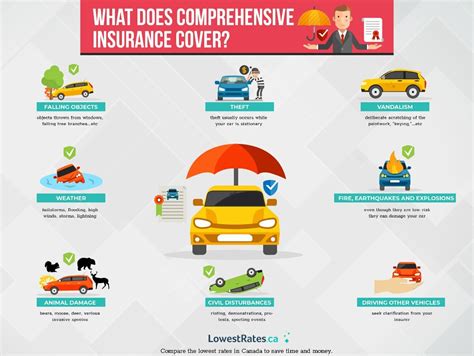

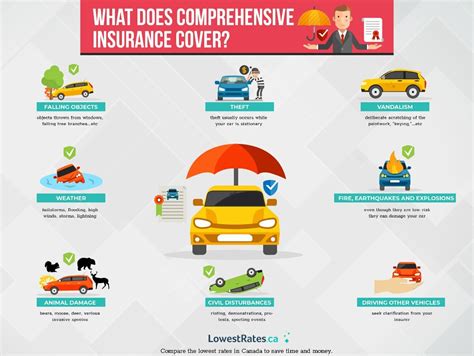

Similarly, if your car is damaged in an accident, comprehensive coverage helps you repair or replace it, minimizing financial strain.

Peace of mind comes from knowing you’re protected, allowing you to focus on what truly matters: your health, your loved ones, and your future.

2. Enhanced Healthcare: Access to Quality Care, Without Breaking the Bank

Healthcare costs continue to rise, making quality care increasingly inaccessible for many. Comprehensive coverage expansion bridges this gap, ensuring everyone has access to the healthcare they need, regardless of their financial situation.

Think about it: regular check-ups, preventive screenings, and access to specialists become attainable.

Early detection and treatment become more likely, leading to improved health outcomes and potentially saving lives.

Comprehensive coverage expansion empowers individuals to prioritize their well-being, knowing they can access quality healthcare without facing insurmountable financial barriers.

3. Business Growth: Unleashing Your Entrepreneurial Potential

For entrepreneurs, comprehensive coverage expansion can be a game-changer.

Imagine starting a business, filled with passion and ambition, but facing financial risks that threaten your dream.

Comprehensive coverage provides a safety net, protecting your business from unforeseen events.

Whether it’s liability claims, property damage, or cyberattacks, expanded coverage helps mitigate financial losses, allowing you to focus on growth and innovation.

This peace of mind allows entrepreneurs to take calculated risks, knowing they’re protected, ultimately leading to greater innovation and economic prosperity.

4. Education Opportunities: Investing in Your Future

Education is a powerful tool for personal and professional growth.

However, the rising cost of education often presents a significant barrier.

Comprehensive coverage expansion can help bridge this gap, providing financial assistance for tuition, books, and living expenses.

Imagine pursuing a degree, learning new skills, or expanding your knowledge base, knowing that financial constraints won’t hold you back.

Comprehensive coverage empowers individuals to invest in their future, unlocking opportunities for career advancement, personal fulfillment, and societal progress.

5. Travel Adventures: Exploring the World with Confidence

Travel broadens horizons, fosters cultural understanding, and creates unforgettable memories.

But travel can also be expensive, and unexpected events can derail even the best-laid plans.

Comprehensive coverage expansion provides peace of mind when exploring the world.

Think about it: medical emergencies, lost luggage, trip cancellations – these situations can be stressful and costly.

With expanded coverage, you’d have financial protection, allowing you to relax, enjoy your journey, and embrace new experiences without worrying about unforeseen circumstances.

6. Retirement Security: Planning for a Comfortable Future

Retirement planning can be daunting, especially in today’s uncertain economic climate.

Comprehensive coverage expansion plays a vital role in securing a comfortable retirement.

Think about it: healthcare costs, inflation, and unexpected expenses can erode your savings.

Expanded coverage provides financial stability, ensuring you have the resources to enjoy your golden years without financial stress.

Whether it’s access to affordable healthcare, income protection, or long-term care assistance, comprehensive coverage helps pave the way for a fulfilling retirement.

7. Peace of Mind: The Ultimate Benefit

Perhaps the greatest benefit of comprehensive coverage expansion is the immeasurable peace of mind it provides.

Knowing you’re protected from life’s uncertainties allows you to live more fully, pursue your passions, and cherish the moments that matter most.

Imagine facing challenges with confidence, knowing you have a safety net to support you.

Imagine embracing opportunities without fear, knowing you’re financially secure.

Comprehensive coverage expansion empowers you to live a richer, more fulfilling life, free from financial worries and anxieties.

FAQ

1. What is “comprehensive coverage expansion”?

- Comprehensive coverage expansion refers to policies or initiatives aimed at widening access to healthcare services and reducing financial barriers for individuals seeking medical treatment.

2. Who benefits from comprehensive coverage expansion?

- Individuals who currently lack health insurance, individuals with inadequate health insurance, individuals struggling to afford healthcare costs, and members of vulnerable communities disproportionately affected by lack of access to healthcare.

3. How does comprehensive coverage expansion change lives?

- It improves access to preventive care, leading to early detection and management of health conditions, reduces financial burden associated with medical expenses, increases health literacy and knowledge, promotes overall well-being, and contributes to a healthier and more productive society.

4. What are some examples of comprehensive coverage expansions?

-

Expanding Medicaid eligibility, creating subsidized health insurance plans through marketplaces, promoting employer-sponsored insurance, improving affordability through cost-sharing reductions, and increasing access to community health centers.

5. Is there evidence that comprehensive coverage expansion works?

-

Yes, studies have shown that comprehensive coverage expansion leads to increased insurance coverage, utilization of healthcare services, improved health outcomes, and reduced financial hardship due to medical expenses.

6. What are the potential challenges of comprehensive coverage expansion?

- Cost, political opposition, administrative complexity, and ensuring quality of care.

7. Where can I find more information about comprehensive coverage expansion in my area?

- Contact your state’s insurance department, healthcare advocacy organizations, or visit websites dedicated to health policy and healthcare access.