Are you tired of dreading dental appointments because of sky-high costs? Do you wonder if quality dental care is even achievable on a budget? You’re not alone. Millions of people struggle with the rising cost of dental insurance, leaving them hesitant to prioritize their oral health. But what if we told you it doesn’t have to be this way?

Discover seven dental insurance plans designed to fit your budget without sacrificing comprehensive coverage. We’ve done the research, scouring the market for the most affordable and valuable options available. From HMOs to PPOs, we’ll break down the key features, pros, and cons of each plan, empowering you to make an informed decision. Get ready to smile confidently, knowing you’ve found dental insurance that works for you—and your wallet.

7 Dental Insurance Plans That Won’t Break the Bank 🦷💰

Taking care of your teeth is crucial for overall health and well-being. However, dental care can be expensive, and navigating the world of dental insurance can feel overwhelming. Don’t worry, you don’t have to choose between a healthy smile and your budget.

We’ve compiled a list of seven affordable dental insurance plans that offer comprehensive coverage without emptying your wallet.

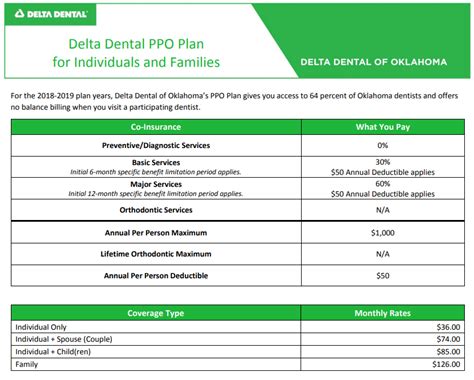

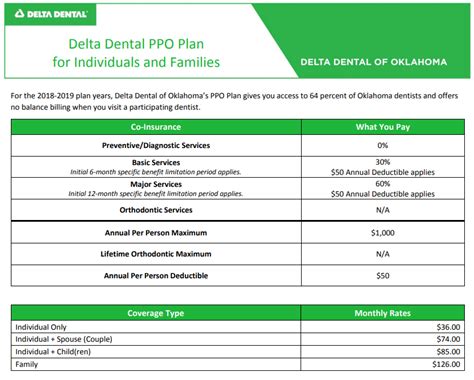

1. Delta Dental

Why it’s Great: Delta Dental is a household name in dental insurance, known for its extensive network of dentists nationwide. They offer various plans with options for individuals, families, and groups, each tailored to different needs and budgets.

What You Get:

- Comprehensive Coverage: Delta Dental plans typically cover preventative care like cleanings and X-rays, basic procedures such as fillings and extractions, and major treatments like crowns and root canals.

- Wide Network: With a vast network of participating dentists, you have the flexibility to choose a provider who aligns with your preferences and location.

Cost: Prices vary depending on the plan and location, but Delta Dental offers a range of options designed to be affordable.

Check it Out: https://www.deltadental.com

2. Aetna Dental

Why it’s Great: Aetna is a well-respected health insurance company that also provides robust dental coverage. Aetna Dental plans are known for their clear and concise plan structures, making it easy to understand what’s covered.

What You Get:

- Choice of Coverage: Aetna offers various plan types, including HMO, PPO, and Indemnity, allowing you to select the option that best suits your needs.

- Wellness Programs: Some Aetna Dental plans include wellness programs and resources to help you maintain good oral health.

Cost: Competitive rates and flexible payment options make Aetna Dental a budget-friendly choice.

Check it Out: https://www.aetna.com/

3. Cigna Dental

Why it’s Great: Cigna is another established insurance company with a strong reputation in the dental care market. Their plans are known for their comprehensive coverage and excellent customer service.

What You Get:

- Preventive Emphasis: Cigna Dental places a strong emphasis on preventative care, often offering generous coverage for cleanings, exams, and X-rays.

- Nationwide Network: Cigna boasts a wide network of dentists across the United States, providing you with convenient access to care.

Cost: Cigna Dental plans are competitively priced and often offer discounts to members with certain professions or health status.

Check it Out: https://www.cigna.com/

4. Humana Dental

Why it’s Great: Humana is a healthcare provider known for its personalized approach and focus on member well-being. Humana Dental plans are designed to be flexible and adaptable to your individual needs.

What You Get:

- Customization Options: Humana Dental offers various plans with different coverage levels and benefits, allowing you to tailor your coverage to your specific requirements.

Cost: Humana Dental plans are priced competitively and often provide discounts for seniors, veterans, and members of certain organizations.

Check it Out: https://www.humana.com/

5. Guardian Dental

Why it’s Great: Guardian is a respected financial services company that also offers dental insurance. Their plans are known for their strong customer support and transparent policies.

What You Get:

- Financial Security: Guardian Dental plans often come with financial safeguards, such as lifetime maximum coverage and fixed premiums.

Cost: Guardian offers competitive rates and flexibility in payment options.

Check it Out: https://www.garduianlife.com/

6. MetLife Dental

Why it’s Great: MetLife is a global financial services leader that provides comprehensive dental insurance plans. They are known for their extensive network and easy-to-use online tools.

What You Get:

- Extensive Network: MetLife Dental has a large network of dentists, making it easy to find a provider in your area.

- Online Tools: MetLife offers convenient online tools for managing your plan, finding dentists, and submitting claims.

Cost: MetLife Dental plans offer competitive pricing and a variety of options to fit your budget.

Check it Out: https://www.metlife.com/

7. UnitedHealthcare Dental

Why it’s Great: UnitedHealthcare is a well-established healthcare provider known for its wide range of plans and excellent customer service.

What You Get:

- Integration with Other Plans: If you have other UnitedHealthcare plans (medical or vision), your dental plan can seamlessly integrate with them.

Cost: UnitedHealthcare Dental offers competitive rates and flexible payment options.

Check it Out: https://www.uhc.com/

Choosing the Right Plan for You

With so many dental insurance options available, it’s essential to carefully consider your needs and budget before making a decision.

Here are some factors to keep in mind:

- Your health status: If you have existing dental issues, you may need a plan with more comprehensive coverage.

- Your financial situation: Set a budget for your dental insurance and look for plans that fit within your range.

- Your dentist: Check if your preferred dentist participates in the plans you’re considering.

- Your family’s needs: If you have a family, explore plans that offer family discounts and coverage for children.

Remember, dental insurance is a valuable investment in your health and well-being.

FAQ 🦷💰

Q: What types of dental insurance plans are covered in this article?

A: This article focuses on PPO, HMO, and Indemnity dental insurance plans.

Q: Are there plans available for individuals, families, and seniors?

A: Yes, the article highlights plans suitable for individuals, families, and seniors with various needs and budgets.

Q: What does “won’t break the bank” mean in the article’s title?

A: It means the article features affordable dental insurance options with competitive pricing and value.

Q: How can I find out if I qualify for a specific plan?

A: The article provides links to the insurance providers’ websites where you can get personalized quotes and eligibility information.

Q: Do these plans cover all dental procedures?

A: No, dental insurance plans typically have specific covered procedures. The article outlines the typical coverage details for each plan type.

Q: What are common factors that influence dental insurance costs?

A: Factors like age, location, dental health history, and desired level of coverage affect premiums.

Q: How can I compare different dental insurance plans?

A: The article offers a breakdown of key factors to consider when comparing plans, such as premium costs, deductibles, co-pays, and maximum benefits.

Q: Does the article offer any tips for maximizing dental insurance benefits?

A: Yes, the article provides tips on understanding your plan, scheduling preventive care, and negotiating fees with dentists.