Are you navigating the confusing world of health insurance, feeling overwhelmed by plan options and worried about hidden costs? 🤯 You’re not alone!

Making the wrong decisions about your health plan can seriously impact your finances, leaving you facing unexpected bills and draining your savings. 💸

Think you’ve got it figured out? Take a closer look. You might be falling prey to common mistakes that cost people thousands of dollars each year.

From overlooking crucial coverage details to misinterpreting jargon-filled documents, there’s a lot that can go wrong.

But don’t panic! 💪 This guide reveals 7 critical health plan mistakes to avoid, empowering you to make smarter choices and protect your hard-earned money. 💰 Get ready to take control of your health and your finances.

7 Health Plan Mistakes That Could Cost You Thousands

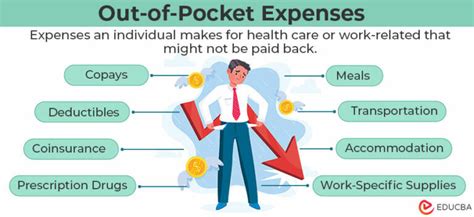

Navigating the world of health insurance can feel like deciphering a secret code. With so many plans, deductibles, co-pays, and out-of-pocket maximums, it’s easy to make mistakes that leave you with hefty medical bills. Don’t let confusion cost you thousands! Here are seven common health plan pitfalls to avoid:

1. Ignoring the Annual Open Enrollment Period

Think of Open Enrollment as your shopping spree for health insurance. It’s the annual period, usually in the fall, when you can make changes to your health coverage. This is your chance to switch plans, add dependents, or even sign up for coverage for the first time.

Why it’s a mistake: Skipping Open Enrollment leaves you stuck with your current plan, even if it’s no longer meeting your needs. You’ll miss out on potentially better options or even risk losing coverage altogether.

The fix: Mark your calendar for Open Enrollment! Research your options and compare plans carefully. Don’t let fear of making a “wrong choice” keep you from making a change that could save you money and stress.

2. Picking the Lowest Premium Without Considering Everything

The lure of a low monthly premium is strong, but focusing solely on this number can be misleading. A seemingly “cheap” plan might have a very high deductible or out-of-pocket maximum, meaning you’ll pay a significant amount if you need medical care.

Why it’s a mistake: Low premiums can be a trap. You might end up paying more in the long run due to larger uncovered expenses.

The fix: Look beyond the monthly premium. Compare deductibles, co-pays, coinsurance, and out-of-pocket maximums. Consider your health needs and potential medical expenses. An online calculator can help you estimate your out-of-pocket costs under different plans.

3. Neglecting to Read the Fine Print

Don’t just skim through the health insurance policy; read it carefully! It’s packed with information about covered services, exclusions, provider networks, and more.

Why it’s a mistake: Missing key details can lead to unexpected bills. You might discover that a crucial service isn’t covered or that your preferred doctor isn’t in the network.

The fix: Set aside time to read your policy thoroughly. Highlight important information, make notes, and don’t hesitate to contact your insurance company if you have questions.

4. Choosing a Plan With Limited Network Options

If you have specific doctors or hospitals you trust, make sure your health plan includes them. Plans with narrow networks can restrict your choices and potentially lead to higher out-of-pocket costs for seeing out-of-network providers.

Why it’s a mistake: Being tied to a plan with limited network options can be inconvenient and expensive if your preferred healthcare providers aren’t included.

The fix: Carefully review the provider networks offered by each plan. Contact your current doctors to confirm they’re in-network. And don’t be afraid to ask if there are plans with broader network coverage that would allow you to keep your current providers.

5. Forgetting About Preventive Care

Many health plans offer free or low-cost preventive care services like checkups, screenings, and vaccinations. Skipping these can lead to missed diagnoses and more serious health problems down the line, which are much more costly to treat.

Why it’s a mistake: Ignoring preventive care can result in more expensive medical bills in the future. Think of these services as an investment in your long-term health and savings.

The fix: Take advantage of your plan’s preventive care benefits! Schedule regular checkups, get recommended screenings, and stay up-to-date on vaccinations.

6. Not Utilizing Online Tools and Resources

Your health insurance provider likely offers online tools that can help you manage your coverage, file claims, and find in-network providers.

Why it’s a mistake: Missing out on these helpful resources can make managing your health insurance more difficult and time-consuming.

The fix: Log in to your online account and explore the features available. Many insurers offer mobile apps as well for even easier access.

7. Failing to Review Your Coverage Regularly

Your health needs and priorities change over time.

Why it’s a mistake: Failing to review your coverage periodically means you might be paying for benefits you don’t need or missing out on coverage that would be beneficial.

The fix: Set a reminder to review your health plan at least once a year, or whenever there are significant changes in your life (marriage, childbirth, loss of a job, etc.).

Protect Your Wallet and Your Health

Don’t let these common health plan mistakes derail your finances or compromise your health. Taking the time to understand your coverage, make informed decisions, and utilize available resources will empower you to navigate the complexities of health insurance with confidence.

What are health plans? Health plans are contracts between you and an insurance company that cover some of the costs of your healthcare.

Why should I be concerned about mistakes with my health plan? Mistakes can lead to higher out-of-pocket costs, denied claims, and gaps in coverage, potentially costing you thousands of dollars.

What are the 7 mistakes discussed in the article?

- Not understanding your plan’s deductible, copay, and coinsurance

- Failing to compare different health plans

- Neglecting to read your Explanation of Benefits (EOB) statement

- Choosing the wrong type of plan for your needs

- Not taking advantage of preventative care benefits

- Forgetting to renew your plan

- Not utilizing prescription drug formularies

How can I avoid these mistakes? The article provides specific tips and advice to help you avoid these common health plan pitfalls.

Where can I find more information about my health plan? You can contact your health insurance provider directly or visit their website.