Are you navigating the complex world of medical underwriting? Worried about hidden costs that could jeopardize your financial well-being? Understanding the nuances of this process is crucial, especially if you’re seeking life, disability, or critical illness insurance.

One misstep during underwriting could significantly impact your premiums, coverage, or even lead to outright rejection. Don’t let costly errors sabotage your hard-earned security.

From overlooking pre-existing conditions to neglecting medication disclosure, numerous common mistakes lurk within this intricate system. Discover seven potential pitfalls that could drain your resources, learn how to avoid them, and secure the coverage you deserve.

Let’s empower yourself with knowledge and navigate medical underwriting with confidence.

7 Medical Underwriting Mistakes That Could Cost You Thousands

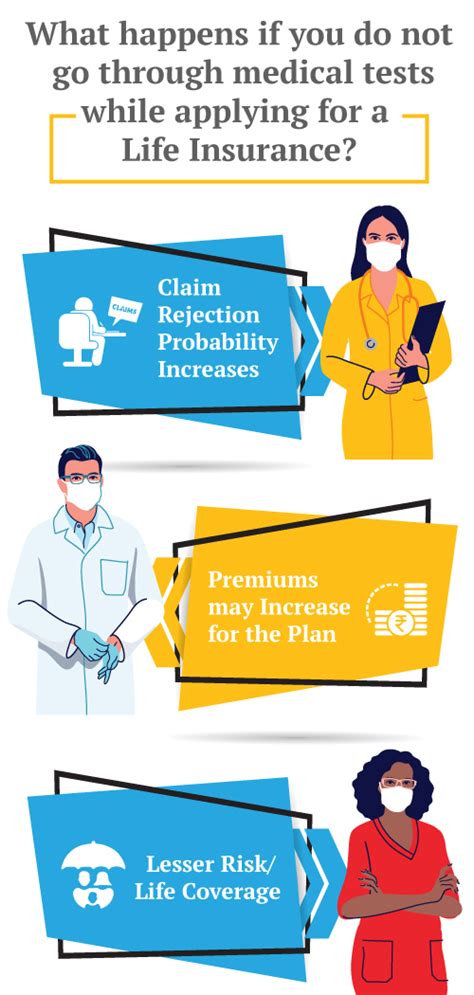

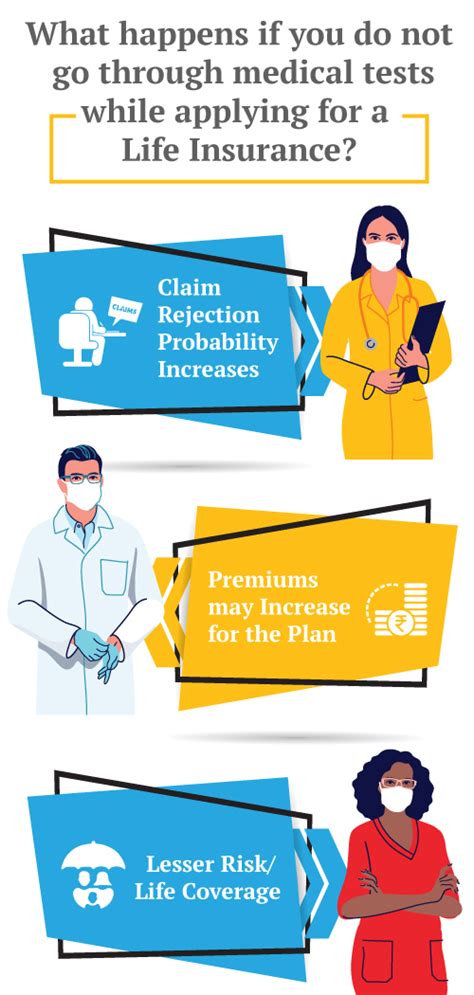

Applying for life insurance can feel overwhelming. Forms, questions about your medical history, and complex jargon can leave you feeling lost. One crucial aspect of the application process is medical underwriting, where insurance companies assess your health to determine your risk level and ultimately, your premium.

But making even small mistakes during medical underwriting can have a big impact on your coverage and your finances. Ignoring seemingly minor details could result in a higher premium, a denied application, or even exclusion of certain health conditions from your policy.

To help you navigate this process successfully, we’ve outlined seven common medical underwriting mistakes to avoid, and what you can do to ensure your application is accurate and effective.

1. Not disclosing pre-existing conditions

This may seem obvious, but it’s one of the most common mistakes applicants make.

Why it’s a problem: Insurance companies rely on accurate information to calculate risk. Withholding pre-existing conditions can be considered fraud and can lead to:

- Denial of your application if your health issues are discovered later.

- Policy cancellation if the condition is not disclosed during the underwriting process.

- Legal ramifications in some cases.

What to do: Be completely transparent about any health concerns, even if they seem minor.

- Remember, conditions that are currently under control still count as pre-existing.

- Don’t rely on your memory alone. Provide documentation from your healthcare providers to support your claims.

2. Inaccurate or incomplete medical history

Even seemingly insignificant details matter.

Why it’s a problem: Inaccuracies can create inconsistencies that raise red flags for underwriters. This could lead to:

- Increased premiums due to a perceived higher risk.

- Requesting additional medical records and tests which can delay the underwriting process.

What to do:

- Review all questions carefully and answer them honestly.

- Provide complete medical history, including family history of diseases.

- Double-check all dates, diagnoses, and treatments.

3. Ignoring lifestyle questions

Don’t assume that lifestyle questions are just generic concerns.

Why it’s a problem: Your lifestyle choices significantly impact your health and risk profile. Answering them inaccurately can:

- Result in underestimation of risk, leading to a lower premium that may not accurately reflect your actual health status.

- Cause your policy to be later voided if discrepancies are discovered during a future claim.

What to do:

- Be truthful about your habits, including smoking, alcohol consumption, and exercise level.

- Understand that some activities, like extreme sports, might trigger additional underwriting scrutiny.

4. Failing to review and understand the policy

Rushing through the application process and skipping the fine print is a recipe for disaster.

Why it’s a problem: Policies can be complex and contain important clauses that may impact your coverage in unforeseen circumstances.

- Not understanding exclusions: You might be surprised to discover that certain medical issues are not covered, especially if they were undisclosed.

- Misinterpreting definitions: Terms like “pre-existing condition,” “exclusion,” and “waiting period” can have specific meanings within the policy.

What to do:

- Read your policy carefully, including the fine print, before signing anything.

- Don’t hesitate to ask your agent or broker to clarify any points you don’t understand.

- Keep a copy of your policy in a safe place for future reference.

5. Withholding information about medications

Always disclosure everything you are taking, even over-the-counter medications.

Why it’s a problem:

- Certain medications can be indicative of pre-existing conditions or may interact with other treatments.

- Failure to disclose could result in a claim being denied if a link is later found between your medications and the health issue you’re claiming.

What to do: Provide a complete list of all medications you take, including dosage and frequency.

6. Incorrectly filling out forms

Even a small typo can create complications.

Why it’s a problem:

- Inaccurate information delays the underwriting process, often requiring you to resubmit forms, causing additional frustration.

- Mistakes can lead to inaccuracies in your risk assessment, potentially resulting in higher premiums or even cancellation.

What to do:

- Proofread your forms carefully before submitting them.

- If you have any questions about the forms, contact your agent or the insurance company directly.

7. Not shoping around

Choosing the first policy you are offered could mean missing out on better deals.

Why it’s a problem:

- Different insurance companies have different underwriting guidelines and criteria. One company might be stricter than another, leading to higher premiums or even denial.

What to do:

- Get quotes from multiple insurers to compare coverage and costs.

Putting It All Together

By avoiding these common mistakes, you can increase your chances of securing a life insurance policy that meets your needs and budget. Remember, taking the time to be thorough and accurate during the medical underwriting process is a wise investment in your future.

Frequently Asked Questions

Q: What is medical underwriting?

A: Medical underwriting is the process insurance companies use to assess the health risks associated with insuring an individual. They review medical history, lifestyle factors, and other relevant information to determine premium rates and eligibility for coverage.

Q: What does it mean if I am denied insurance coverage?

A: If you are denied coverage, it means the insurance company considers your health risk too high and is unwilling to provide you with a policy.

Q: Can I appeal a denial of coverage?

A: Yes, most insurance companies have an appeals process. You can submit documentation to support your case and request a review of the decision.

Q: Can I get insurance coverage even if I have pre-existing conditions?

A: In the United States, the Affordable Care Act (ACA) prohibits insurers from denying coverage based solely on pre-existing conditions.

Q: How do I avoid making medical underwriting mistakes?

A: Be thorough and honest when providing information to the insurance company. Review your medical history carefully and disclose any relevant conditions or treatments.

Q: What should I do if I make a mistake on my application?

A: Contact the insurance company immediately and notify them of the error. They may be able to make corrections depending on the situation.

Q: Can my family’s medical history impact my insurance premiums?

A: In some cases, your family’s medical history may be considered, especially if there are genetic predispositions to certain conditions.

Q: How can I find an insurance agent who can help me navigate the medical underwriting process?

A:

You can search online for insurance agents in your area who specialize in health insurance. Consumer advocacy groups and professional organizations may also offer referrals.